A promissory note is a legally binding document that outlines the terms and conditions of a loan agreement between two parties. It serves as a written promise to repay a specific amount of money within a defined period of time. Whether you are lending or borrowing money, having a promissory note in place can provide clarity and protection for both parties involved.

Key Elements of a Promissory Note

When creating a promissory note, there are several key elements that should be included:

When creating a promissory note, there are several key elements that should be included:

- Loan Amount: Clearly state the amount of money being borrowed.

- Interest Rate: If applicable, include the interest rate that will be charged on the loan.

- Repayment Terms: Specify the repayment schedule, including the due date and frequency of payments.

- Collateral: If the loan is secured by collateral, such as a property or vehicle, include details about the collateral.

- Default: Outline the consequences of defaulting on the loan, such as late fees or legal action.

- Signatures: Both the lender and borrower should sign and date the promissory note to make it legally binding.

Why Use a Promissory Note?

Using a promissory note has several benefits for both the lender and borrower:

Using a promissory note has several benefits for both the lender and borrower:

- Clarity: A promissory note clearly outlines the terms of the loan, reducing the chance of misunderstandings or disputes.

- Legal Protection: By having a written agreement, both parties have legal recourse in the event of non-payment or breach of the loan terms.

- Documentation: A promissory note serves as a legal document that can be used as proof of the loan and the agreed-upon terms.

- Tax Purposes: If the loan involves interest payments, having a promissory note can help with tax reporting.

How to Create a Promissory Note

Creating a promissory note is relatively simple. You can find many templates online to help guide you through the process. Here are the basic steps to follow:

Creating a promissory note is relatively simple. You can find many templates online to help guide you through the process. Here are the basic steps to follow:

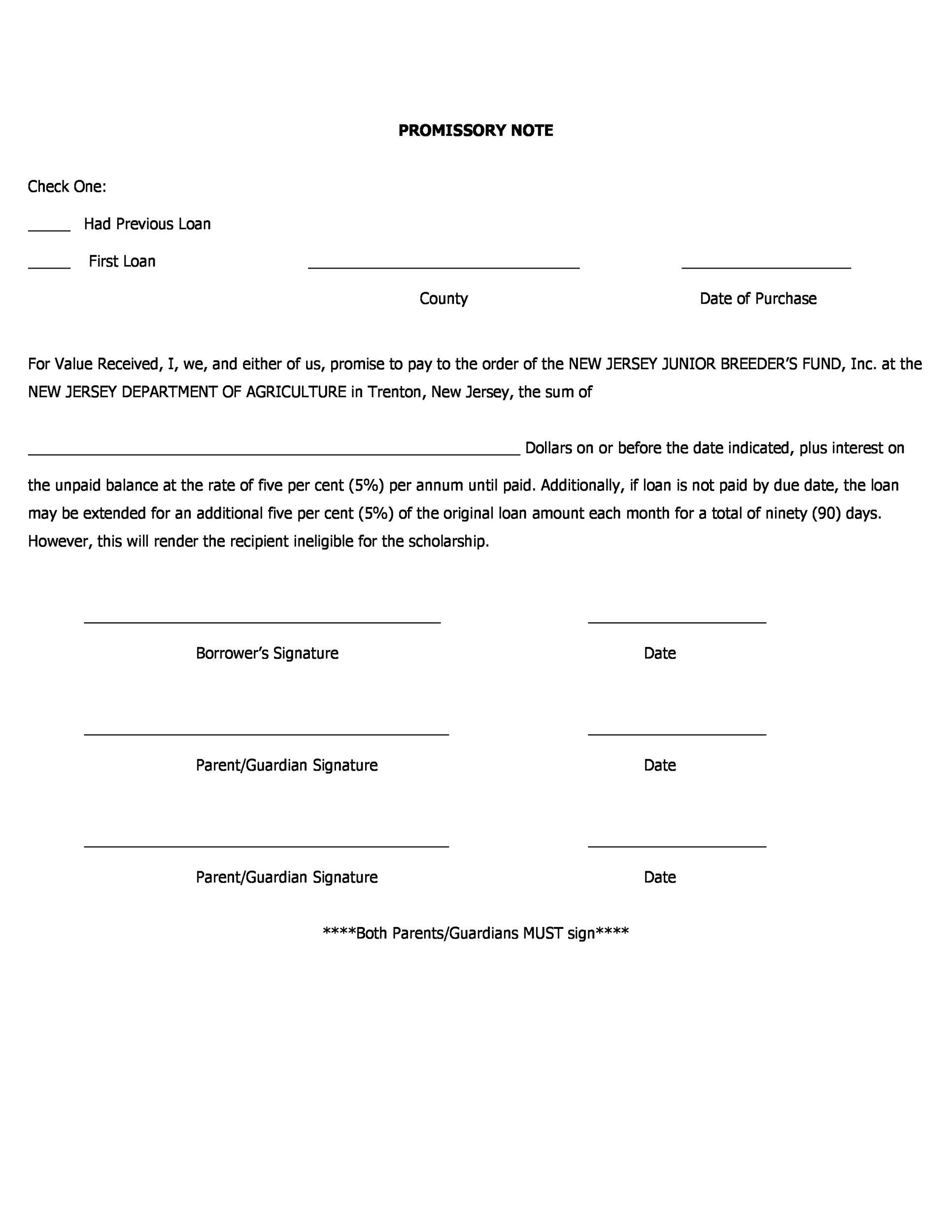

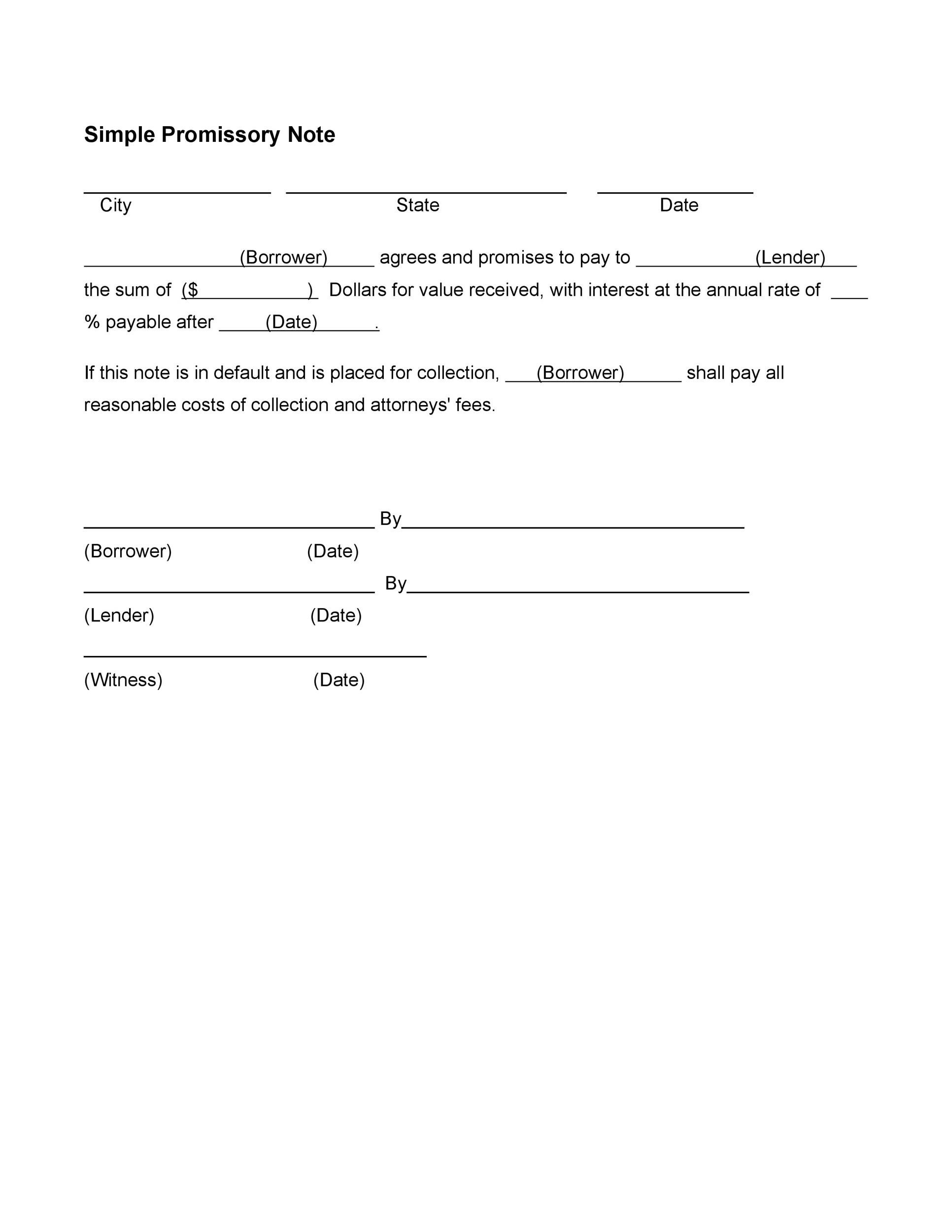

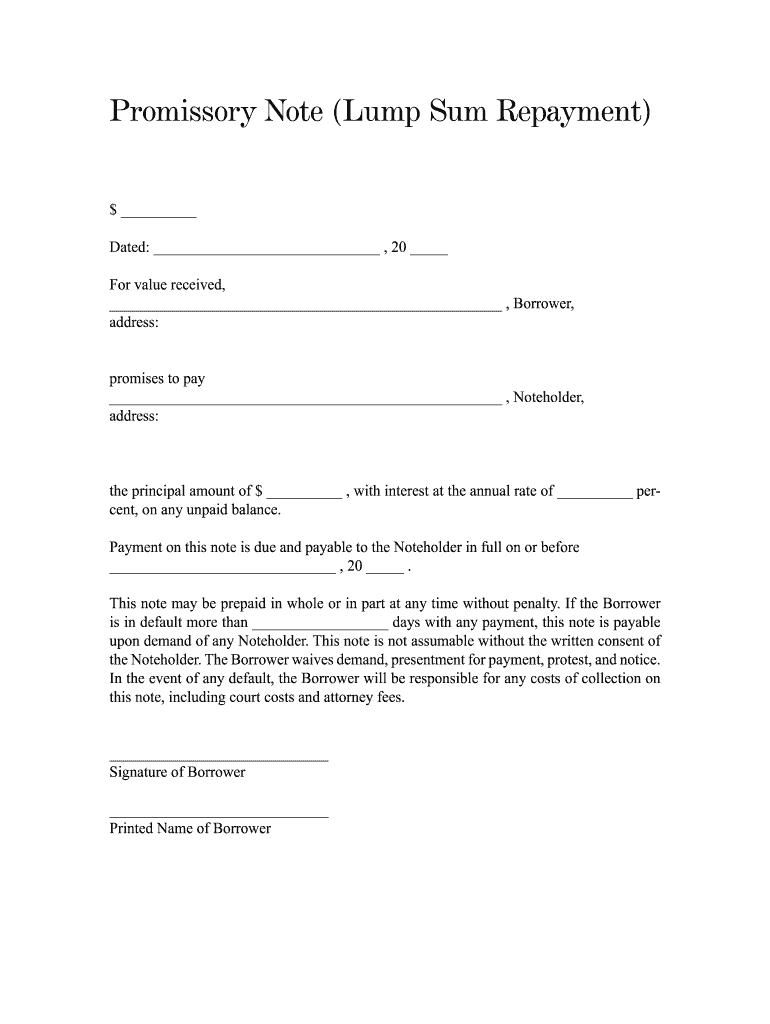

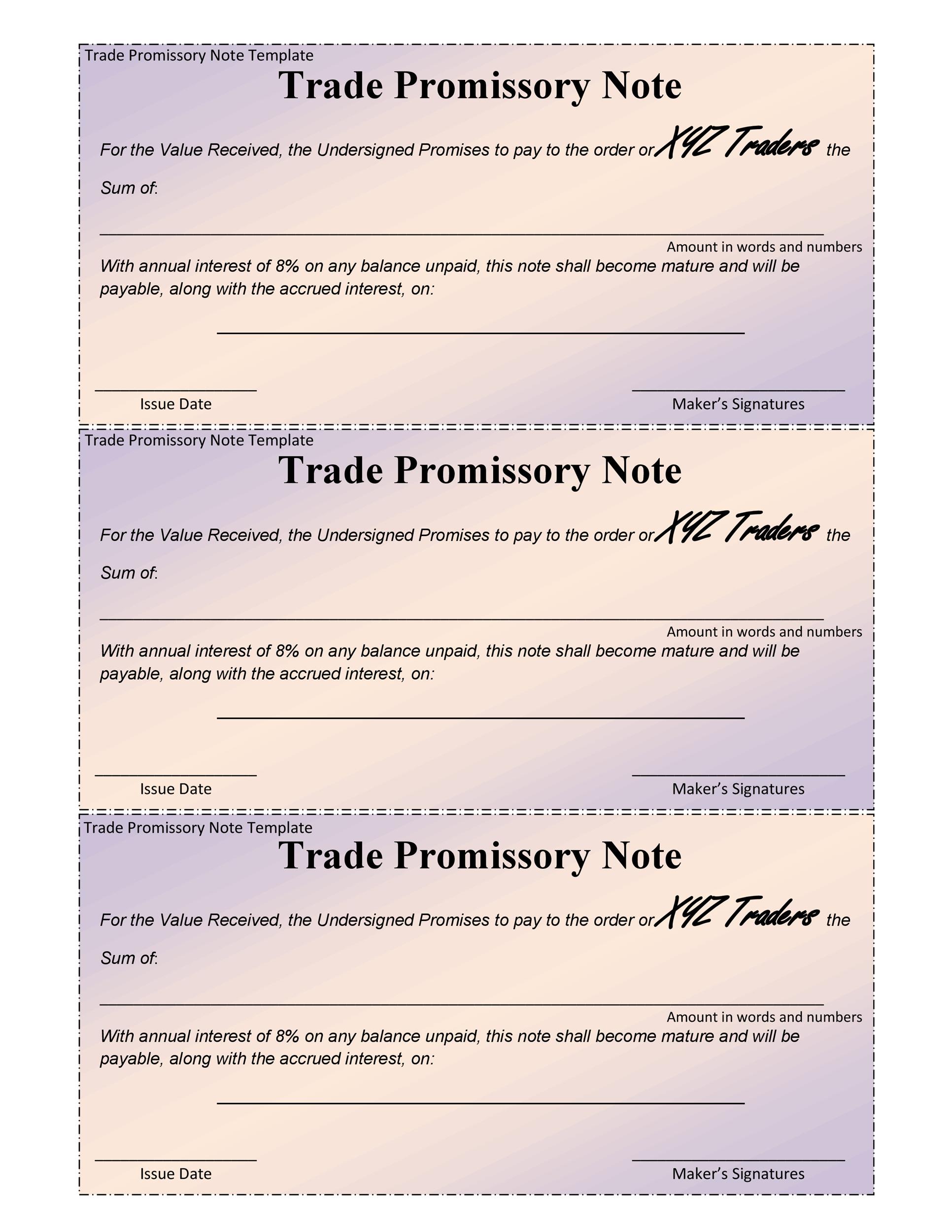

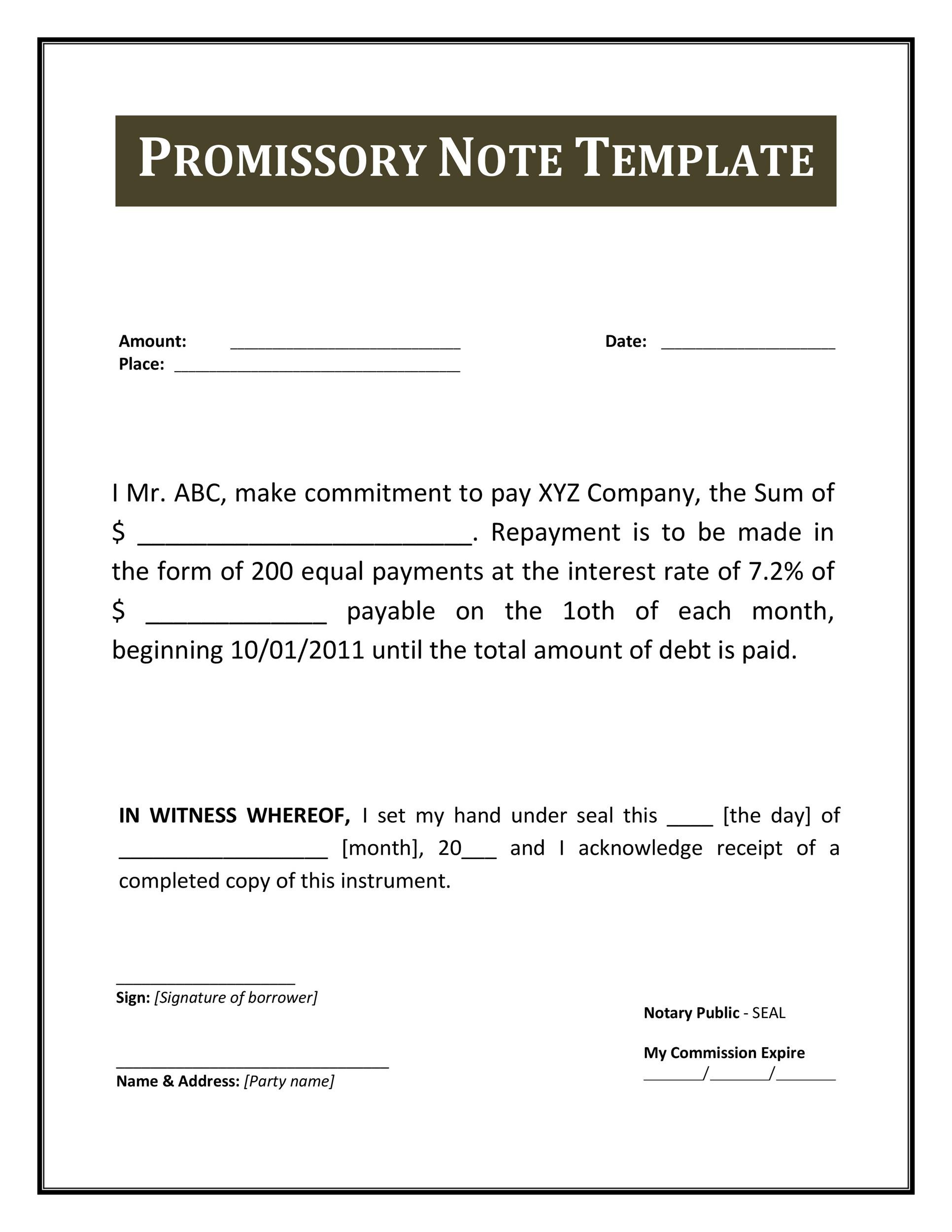

- Choose a template: Look for a promissory note template that suits your needs. Make sure it includes all the necessary elements discussed earlier.

- Edit the template: Customize the template by filling in the loan amount, interest rate, repayment terms, and any additional clauses or conditions specific to your agreement.

- Review and finalize: Carefully review the promissory note to ensure accuracy and clarity. Both parties should thoroughly understand and agree to the terms before signing.

- Sign and date: Once the promissory note is reviewed and agreed upon, both the lender and borrower should sign and date the document. Consider having witnesses present to further strengthen its legality.

Finding Promissory Note Templates

There are numerous resources available online where you can find free promissory note templates. Websites like TemplateLab offer a wide range of templates that can be customized to fit your specific needs.

There are numerous resources available online where you can find free promissory note templates. Websites like TemplateLab offer a wide range of templates that can be customized to fit your specific needs.

Additionally, you can find printable promissory note PDFs that can be filled out digitally or manually. These templates are convenient and easy to use, providing a professional-looking document for your loan agreement.

Conclusion

Whether you are lending or borrowing money, a promissory note is a valuable tool that can help protect your interests and provide clarity in your loan agreement. By clearly outlining the terms and conditions of the loan, both parties can have peace of mind knowing their rights and obligations are defined.

Whether you are lending or borrowing money, a promissory note is a valuable tool that can help protect your interests and provide clarity in your loan agreement. By clearly outlining the terms and conditions of the loan, both parties can have peace of mind knowing their rights and obligations are defined.

When creating a promissory note, it’s essential to include all the necessary elements and ensure the document is signed and dated by both parties. Using a promissory note template can simplify the process and ensure you have a legally binding agreement in place.

Remember to consult legal professionals or financial advisors if you have any specific questions or concerns regarding your promissory note. By taking the necessary steps to create a well-structured promissory note, you can ensure a smooth loan process and minimize potential conflicts or misunderstandings.

References: