In today’s digital age, it is essential to stay informed about various tax forms and documents. One such crucial form is the W9 Tax Form, which is used for obtaining the taxpayer identification number and certification. Whether you are an employer or a freelancer, understanding the W9 Tax Form and its implications is vital for financial purposes.

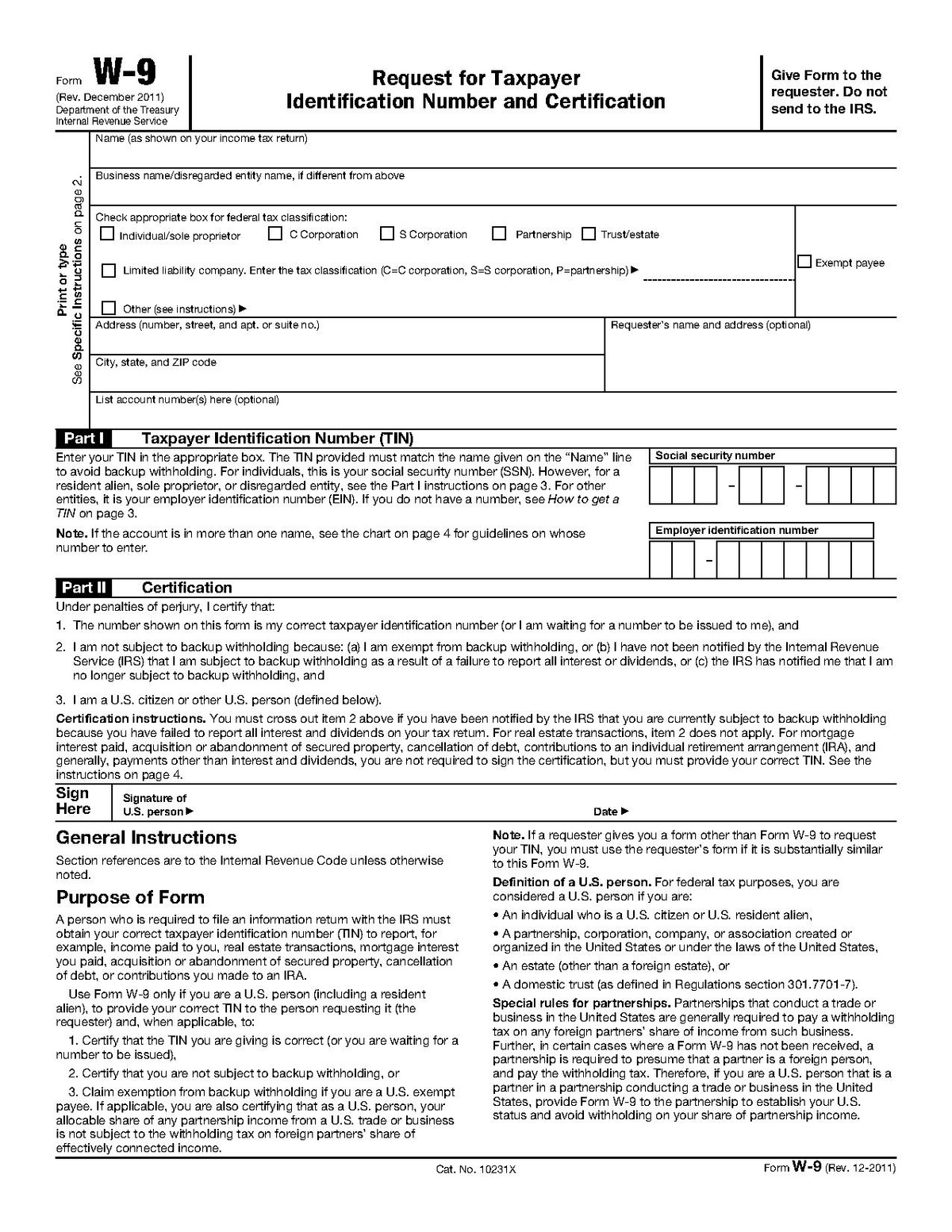

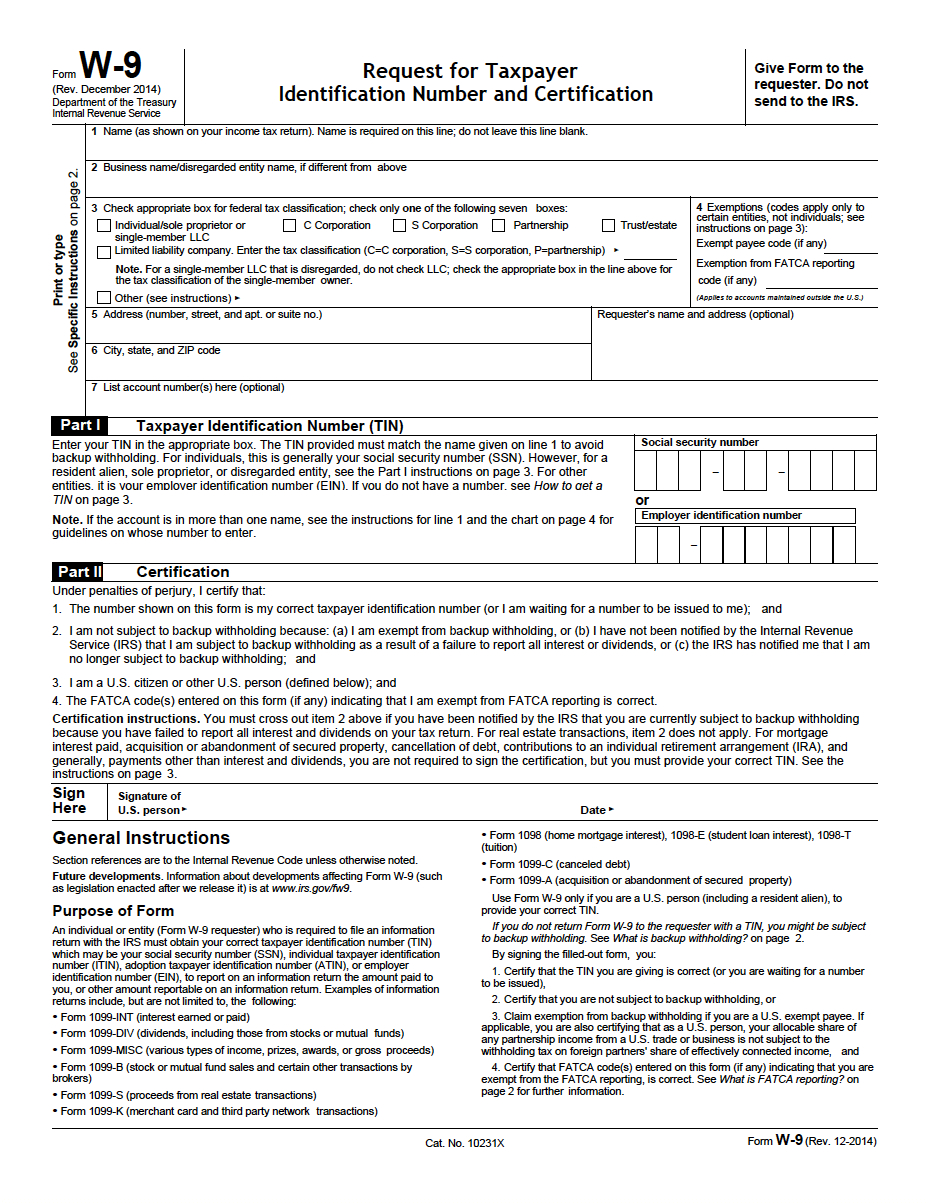

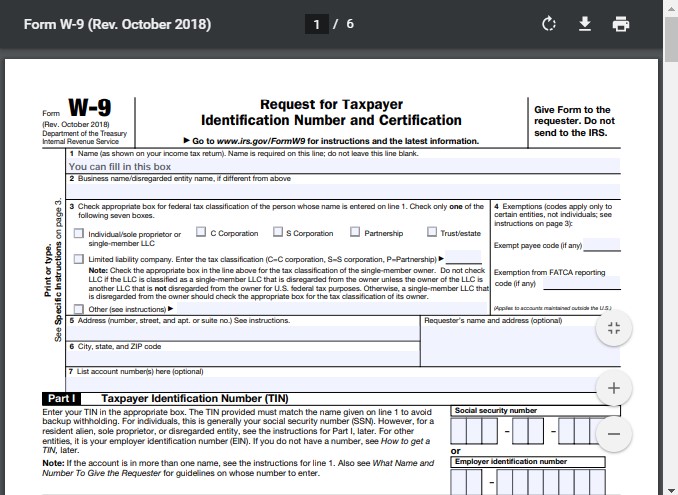

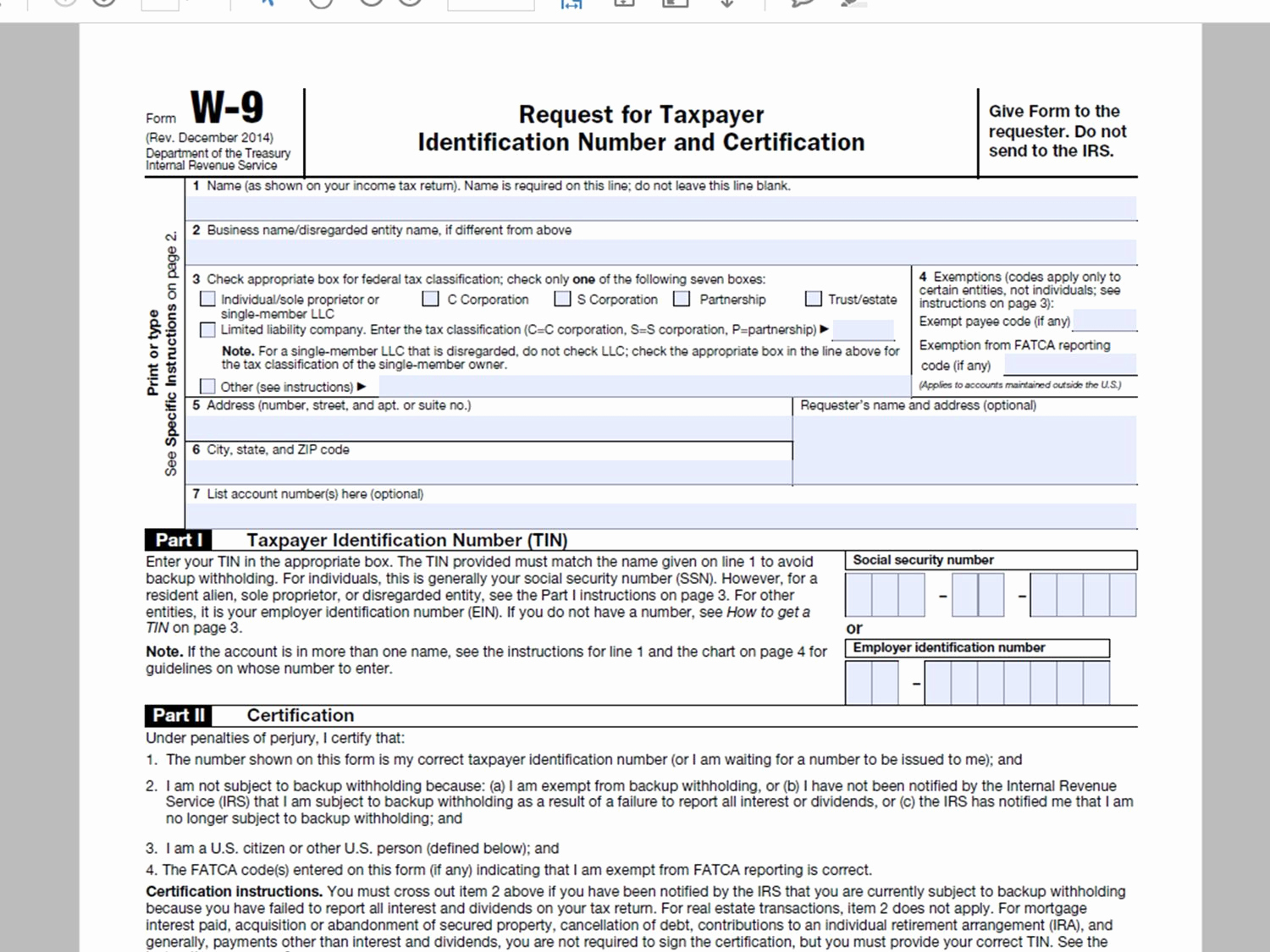

The W9 Tax Form is a standardized document issued by the Internal Revenue Service (IRS) in the United States. It is primarily used to gather information from individuals or entities who provide services to businesses, such as independent contractors or freelancers. The form collects the taxpayer identification number (TIN) and certification of the taxpayer.

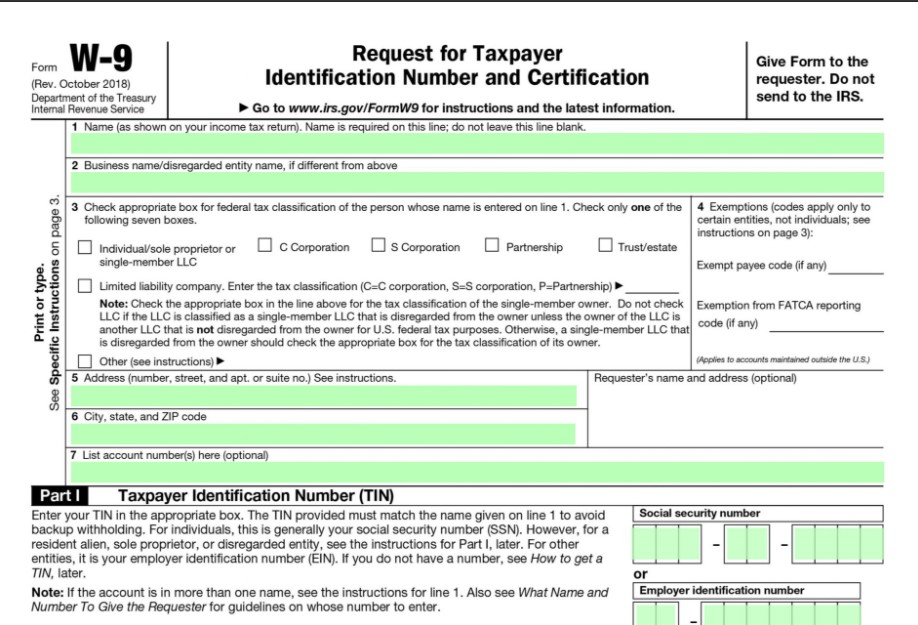

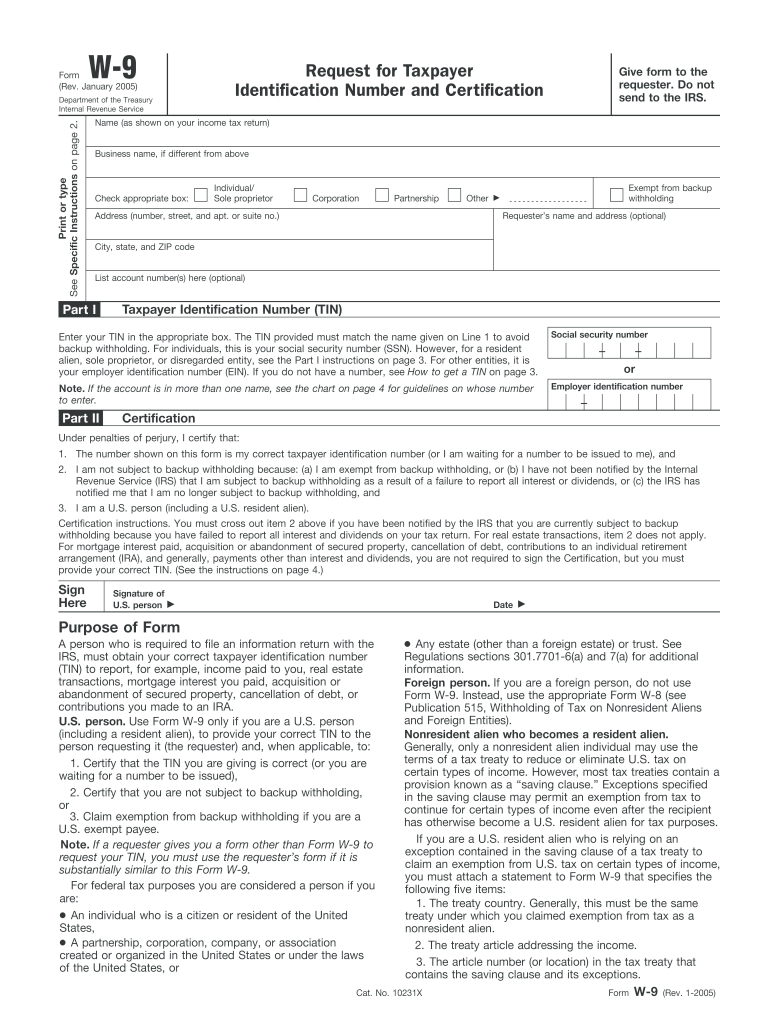

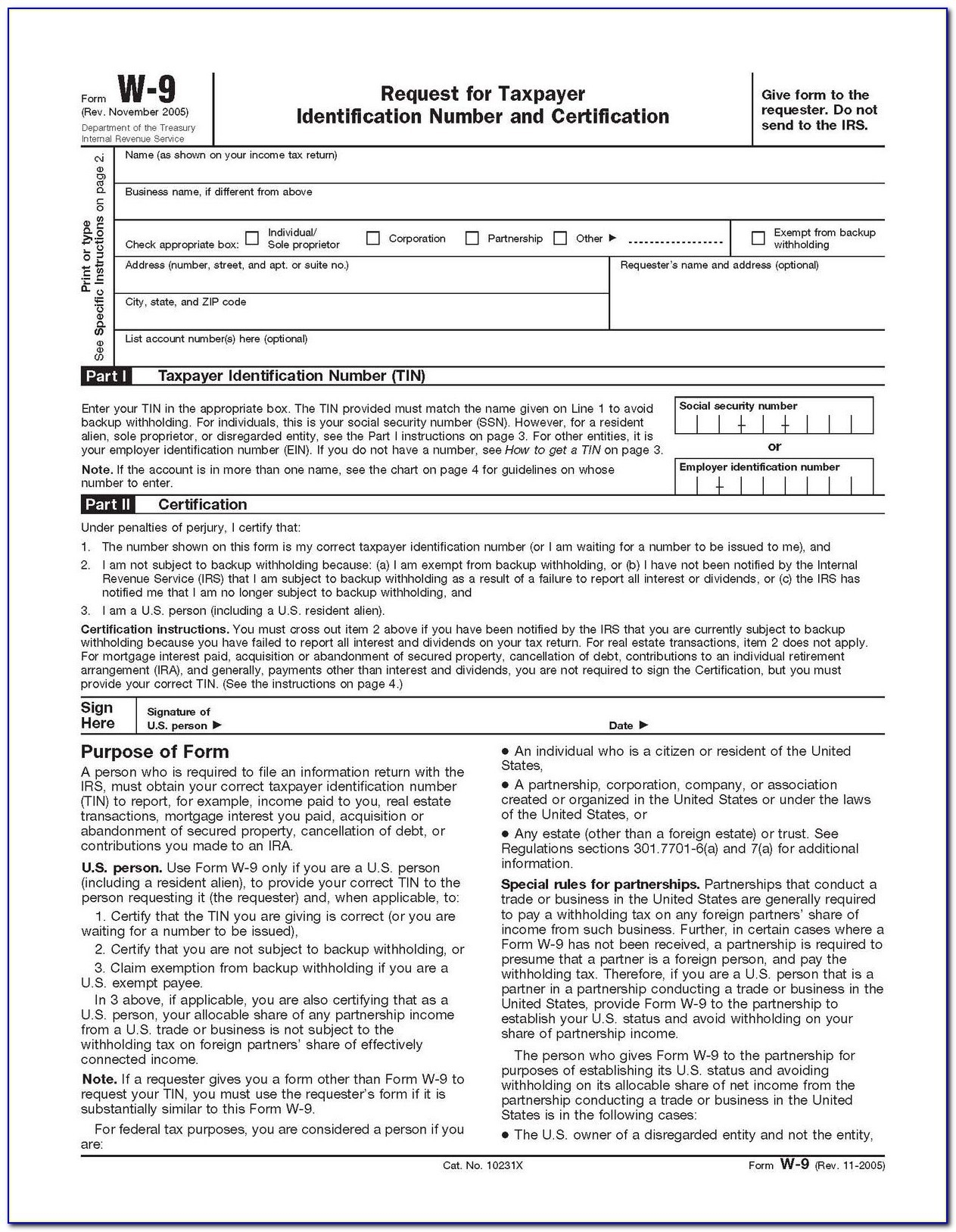

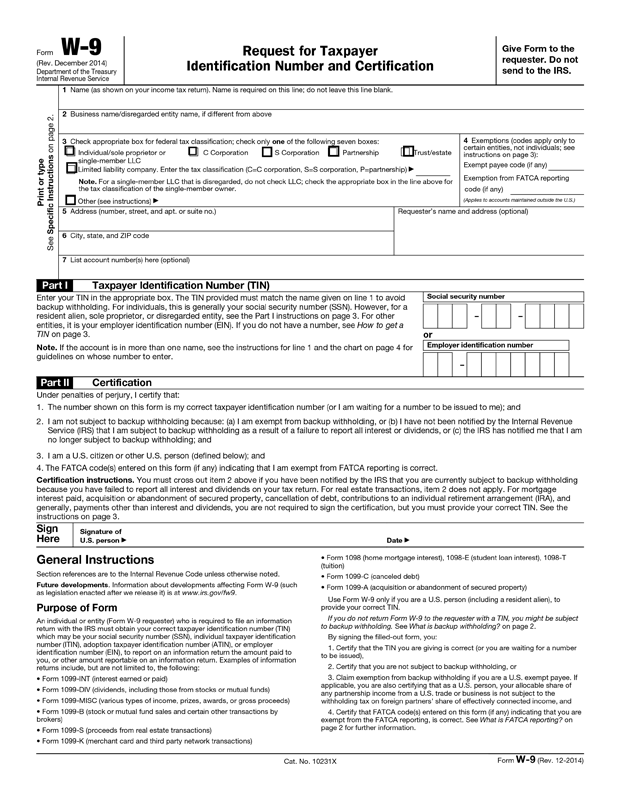

To fill out the W9 Tax Form, there are several important details you need to provide. This includes your name, business name (if applicable), mailing address, and TIN. The TIN can be your Social Security Number (SSN) or Employer Identification Number (EIN), depending on your situation. Additionally, you may need to specify the account type, such as an individual, corporation, partnership, or other entity.

It is crucial to ensure the accuracy of the information provided on the W9 Tax Form as any mistakes or discrepancies can lead to issues with your tax filings. A correctly filled-out form helps the payers (employers or clients) to report your income accurately to the IRS.

If you are unsure about how to correctly fill out the W9 Tax Form, there are resources available to guide you through the process. The IRS provides detailed instructions on their official website, which can help clarify any confusion you may have. Additionally, various online platforms offer printable versions of the W9 Tax Form, making it convenient for you to access and fill out the form according to your requirements.

It is important to note that the W9 Tax Form is not submitted to the IRS. Instead, it is provided to the payer (employer or client), who is responsible for keeping the form on file and using the information provided to prepare and submit the necessary tax documents, such as Form 1099-MISC.

While the W9 Tax Form may seem like a straightforward document, it is crucial to understand its purpose and implications. Providing accurate information and keeping your records up to date ensures smooth financial transactions and prevents any complications with your tax filings.

In conclusion, the W9 Tax Form is an essential document for both individuals and businesses involved in financial transactions. Whether you are an independent contractor, freelancer, or employer, understanding how to properly fill out and provide the W9 Tax Form is crucial for accurate reporting of income to the IRS. By utilizing printable versions of the form and following the instructions provided by the IRS, you can ensure that you are meeting your tax obligations and maintaining transparency in your financial affairs.

Stay updated with the latest requirements and changes regarding the W9 Tax Form to avoid any unnecessary penalties or legal issues. Being informed and proactive when it comes to your tax obligations is crucial for maintaining financial well-being and compliance.

Remember, it is always beneficial to consult a tax professional or accountant if you have specific questions or uncertainties regarding the W9 Tax Form or any other tax-related matters. They can provide personalized guidance and ensure that you are fulfilling your obligations correctly.

So, whether you are filling out a W9 Tax Form for the first time or refreshing your knowledge, make sure to gather accurate information, stay up to date with any changes or updates, and seek professional guidance if needed. This will help you navigate the complexities of tax compliance effectively and ensure smooth financial operations in the long run.

To access printable versions of the W9 Tax Form and other helpful resources, you can explore reputable websites like PapersPanda.com, Calendar Template Printable, and Free Printable. These platforms offer user-friendly interfaces and a wide range of downloadable forms and templates that can assist you in meeting your tax obligations efficiently.

Remember, maintaining accurate tax records and staying informed about important forms like the W9 Tax Form is essential for financial success and compliance. Take the time to understand the requirements, seek guidance when needed, and keep your financial affairs in order. By doing so, you will ensure a smooth and hassle-free tax filing experience.