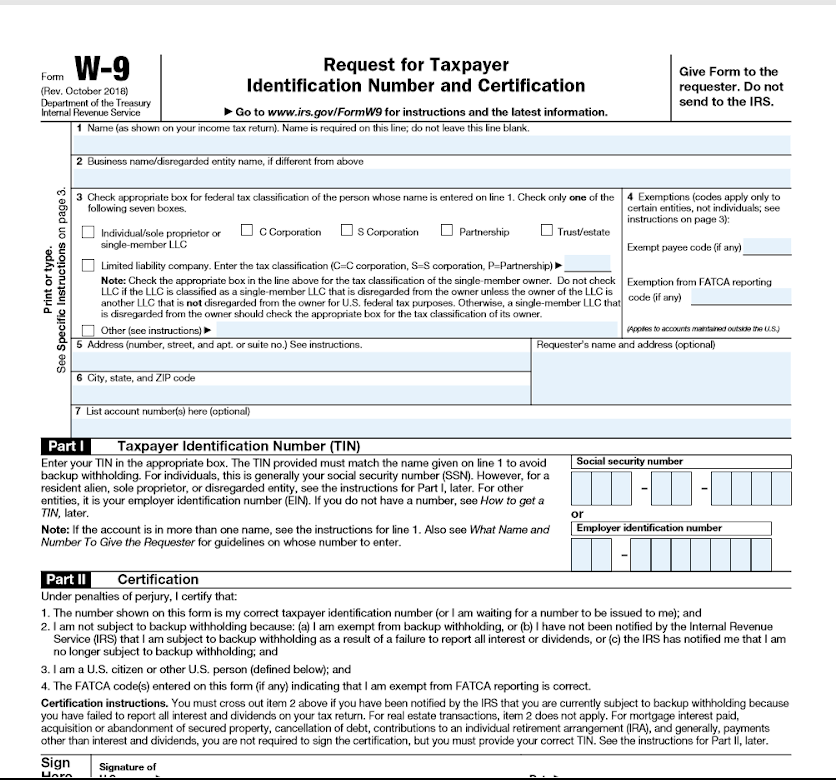

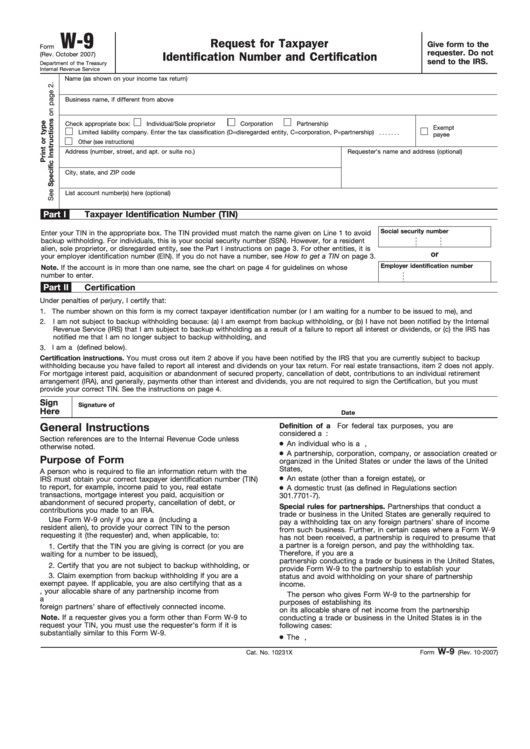

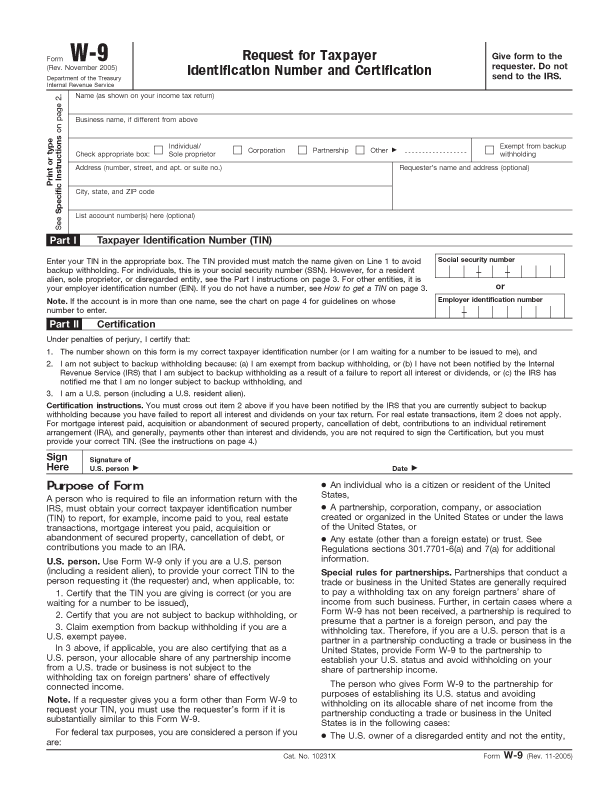

When it comes to filling out IRS Form W-9 for the years 2020-2021, understanding the process and ensuring accuracy is crucial. This form is used to request the taxpayer identification number (TIN) of individuals or entities, such as independent contractors or freelancers, for reporting income to the Internal Revenue Service (IRS).

How to Fill Out IRS Form W-9

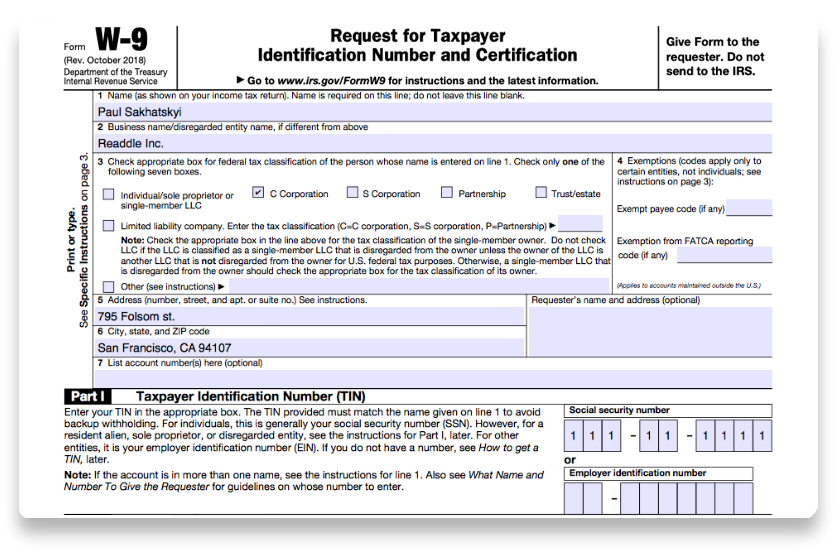

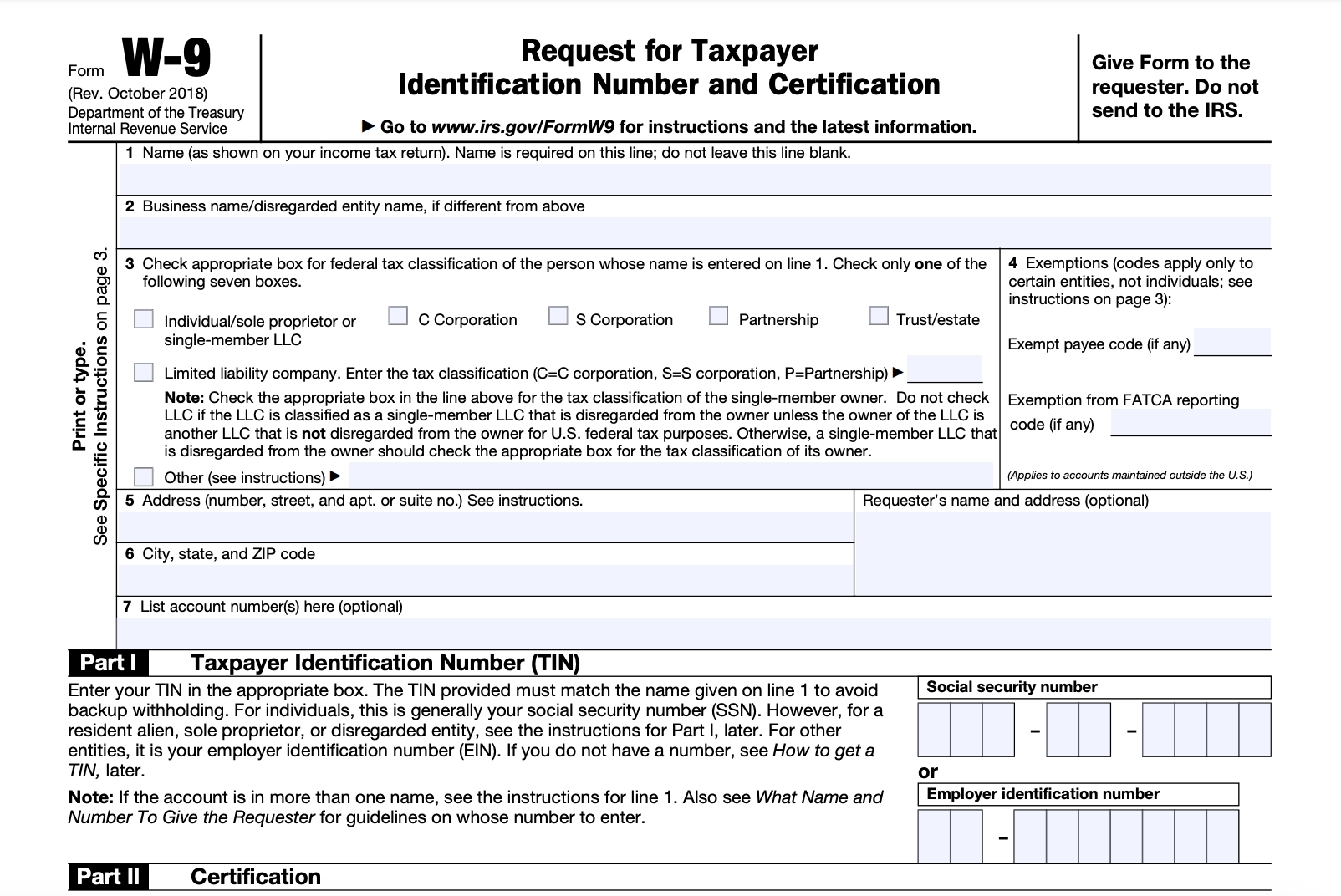

The first step in filling out IRS Form W-9 is to provide your name. If you are operating under a business name, you should also include it on the form. It is important to ensure that the name provided matches the official documentation you use for tax purposes. Any discrepancies may result in delays or complications with your tax filings.

The first step in filling out IRS Form W-9 is to provide your name. If you are operating under a business name, you should also include it on the form. It is important to ensure that the name provided matches the official documentation you use for tax purposes. Any discrepancies may result in delays or complications with your tax filings.

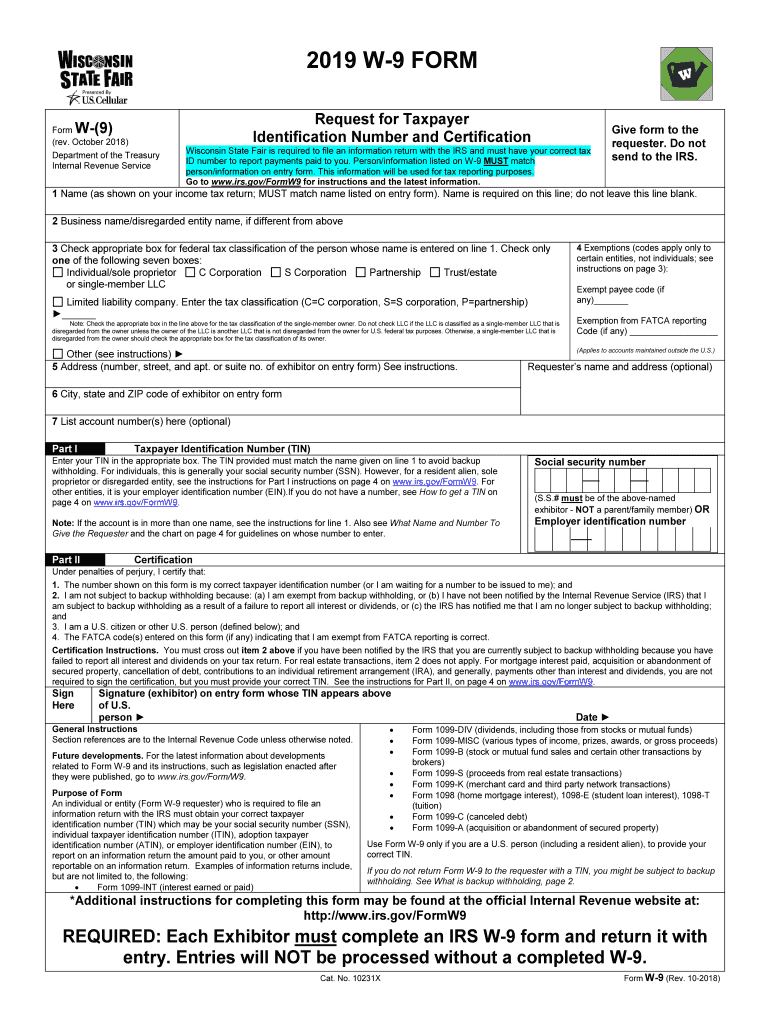

The next section of the form requires you to select the appropriate federal tax classification. This classification is based on your status and the type of business entity you represent. Some common options include “individual/sole proprietor,” “C corporation,” and “limited liability company (LLC).” It is crucial to select the correct classification, as it will determine how your income is reported and taxed.

Following the tax classification section, you will need to provide your TIN. For individuals, this is typically your Social Security Number (SSN). If you are a business entity, you will need to provide your Employer Identification Number (EIN). It is essential to double-check the accuracy of the TIN provided to avoid any potential issues with tax filings.

Following the tax classification section, you will need to provide your TIN. For individuals, this is typically your Social Security Number (SSN). If you are a business entity, you will need to provide your Employer Identification Number (EIN). It is essential to double-check the accuracy of the TIN provided to avoid any potential issues with tax filings.

Once you have completed the personal information section, you will need to certify the accuracy of the provided information. By signing the form, you are stating that the TIN is correct and that you are not subject to backup withholding. It is important to carefully review the information provided before signing the form.

Once you have completed the personal information section, you will need to certify the accuracy of the provided information. By signing the form, you are stating that the TIN is correct and that you are not subject to backup withholding. It is important to carefully review the information provided before signing the form.

Key Considerations for Form W-9

When filling out Form W-9, it is essential to keep a few key considerations in mind:

When filling out Form W-9, it is essential to keep a few key considerations in mind:

- Accuracy: Ensure that all information provided, including your name, tax classification, and TIN, is accurate.

- Taxpayer Type: Select the appropriate federal tax classification based on your current status and business entity.

- TIN Validation: Double-check the accuracy of your TIN to avoid any potential issues with tax filings.

- Certification: Review the completed form and certify the accuracy of the information provided before signing.

Understanding and correctly completing IRS Form W-9 is essential for accurate tax reporting. By following the instructions and ensuring accuracy, you can avoid potential issues and ensure compliance with IRS regulations. Consulting a tax professional can provide further guidance and assistance in filling out Form W-9.

Understanding and correctly completing IRS Form W-9 is essential for accurate tax reporting. By following the instructions and ensuring accuracy, you can avoid potential issues and ensure compliance with IRS regulations. Consulting a tax professional can provide further guidance and assistance in filling out Form W-9.

Conclusion

IRS Form W-9 is a crucial document for individuals and entities who need to report their income to the IRS. By carefully filling out this form, providing accurate information, and certifying its accuracy, you can ensure compliance with tax regulations and avoid potential delays or complications with your tax filings.

IRS Form W-9 is a crucial document for individuals and entities who need to report their income to the IRS. By carefully filling out this form, providing accurate information, and certifying its accuracy, you can ensure compliance with tax regulations and avoid potential delays or complications with your tax filings.

If you are unsure about any aspect of Form W-9 or need assistance in its completion, it is advisable to consult with a tax professional. They can provide expert guidance and ensure that you fill out the form accurately, minimizing the risk of errors or penalties.

By taking the necessary steps to correctly fill out IRS Form W-9, you can ensure that your tax reporting is accurate and in compliance with federal regulations. Understanding the purpose of this form and following the provided instructions will help you navigate the process smoothly and avoid any potential issues that may arise.

By taking the necessary steps to correctly fill out IRS Form W-9, you can ensure that your tax reporting is accurate and in compliance with federal regulations. Understanding the purpose of this form and following the provided instructions will help you navigate the process smoothly and avoid any potential issues that may arise.

References:

- How to fill out IRS Form W-9 2020-2021 - PDF Expert

- Mn 2019 w 9 form - Fill Out and Sign Printable PDF Template - SignNow

- 2020 W9 Blank Tax Form - Calendar Template Printable

- Free W 9 Form Printable - Calendar Printables Free Blank

- Fill A W9 - Fill Out and Sign Printable PDF Template - signNow

- W9 vs 1099: IRS Forms, Differences, and When to Use Them 2019 - Fit Small Business

- 2021 W9 Form Printable Irs - Calendar Template Printable

- w9 forms 2019 printable - PrintableTemplates

- W-9 Form 2019 Printable - IRS W-9 Tax Blank in PDF - PDFfiller

- W 9 Form For 2020 Printable - Example Calendar Printable